COVID-19 and Compensation: What to Think About

According to a recent survey by Willis Towers Watson, in mid-February some 15% of participant companies expected material impacts from COVID-19 to persist over the next six months. As we all know, the situation has continued to evolve around the world, injecting increasing levels of uncertainty in the corporate world, sending financial markets into disarray and adding to our worries at home. Now, one month later that percentage of companies concerned about longer-term impacts is markedly higher.

Recognizing the issues facing the corporate community are complex and many, we wanted to provide some high-level guidance on what management teams and boards of directors should be thinking about as it relates to compensation in these uncertain times.

Base Salaries

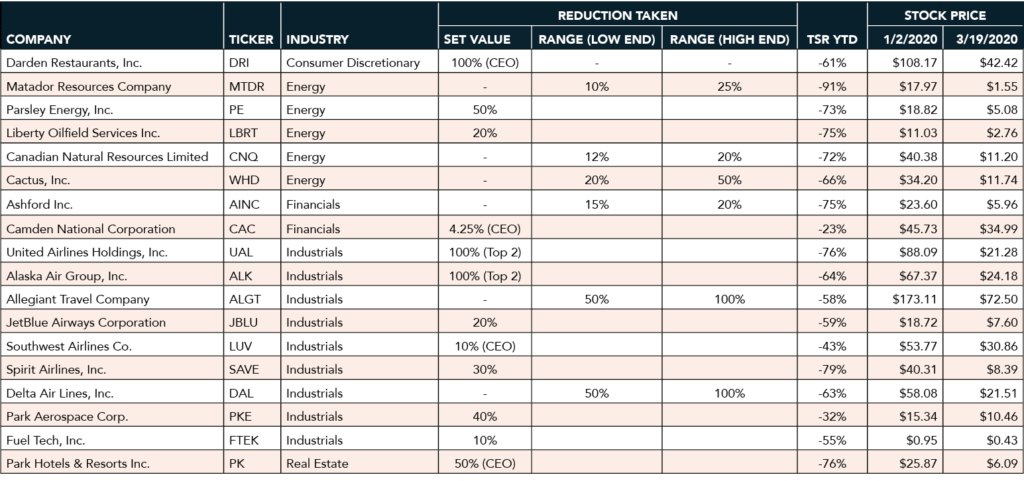

On what seems to be a daily basis, publicly-traded companies are announcing a variety of adjustments to their operating activities in response to the ongoing uncertainties impacting the global economy. In many cases, management teams are voluntarily reducing salary levels in connection with the changes in activity. While there is no established rule of thumb on when to cut and how much, NFPCC has been monitoring announcements and has provided some trends based on data to date for reference. Given the intensity of the spotlight on executive compensation in normal market conditions, a temporary reduction in executive salaries may very well produce an outsized impact on market perception in today’s climate.

Examples of some changes thus far in 2020:

If your company is making significant changes to its operational and financial plans for an unknown period of time, or if it is considering G&A cuts through headcount reductions or furloughs, the cutting of base salaries of senior management for a time may be warranted so that challenging circumstances equally impact all areas of the organization.

Annual Incentives

While the onset of a public health crisis is always cause for concern, the timing of its arrival and spread in the U.S. is a perfect storm for annual incentive programs for fiscal 2020. In this Say on Pay environment, shareholders and proxy advisory firms have pushed for structures that are based largely on quantitative goals and objectives in an effort to enhance clarity on cash variable pay decisions at year end. Given that most calendar year companies had just recently adopted, or were in the final stages of adopting, goals and objectives for 2020 annual incentives using assumptions that were based on a very different business environment, questions abound as to what they should do in response to COVID-19. A few strategies to consider:

1. USE DISCRETION

Where possible, we are proponents of some element of discretionary performance assessment within annual incentive programs – largely for scenarios just like this. When compensation committees fully commit their executive teams’ annual incentive opportunities to formulaic goals and objectives, it severely restricts their abilities to reward for decisive actions and performance in other areas that might have more meaningful impacts to near-term success than what’s laid out in the annual incentive structures. Doing so in this environment also erodes the level of line of sight executives have to impact pay outcomes. While we recognize the elimination of certain elements of Section 162(m) allows compensation committees more flexibility to positively adjust annual incentive payments, the corporate governance landscape is one that historically has not reacted warmly to such actions.

2. ESTABLISH QUARTERLY GOALS

Another strategy to consider is the use of quarterly performance hurdles as opposed to annual ones. In some industries, while the annual picture may still be hazy – think of the number of companies that have made statements recently that their annual guidance numbers for FY2020 shouldn’t be relied upon – boards and management teams may have better clarity on a quarter-by-quarter basis. This would allow companies the opportunity to adjust the performance hurdles each quarter and have a good level of confidence that hurdles are calibrated correctly to market conditions. However, be aware that this approach does elevate and extend the administrative burden on compensation planning for management teams and boards of directors.

3. DELAY GOAL SETTING

Some in our community believe the business impacts of COVID-19 may not be as long-term. In those cases, it might make sense to simply postpone the setting of performance hurdles until a later date. There is a good argument supporting this – does it make sense to set short-term strategy at the peak of a volatile occurrence that is impacting business operations and financial markets? The obvious answer is no. So while this sounds like a winner of a strategy, companies must also recognize the impact on the employee population whose annual incentive opportunities are subject to such goals. The longer a company goes without establishing the performance hurdles that need to be met to realize annual incentives, the more doubt and negative sentiment will grow amongst that population, especially those outside of the executive ranks.

4. MODIFY GOALS ALREADY SET

For those companies that have already set performance goals for 2020, we often get the question of how should we modify said goals given the current environment. Outside of adopting discretion (or a greater degree of), this is one of our least favorable strategies to consider, albeit potentially necessary. First, the situation is still quite fluid and volatile, as evidenced by the number of circuit breakers the markets have hit in mid-March. Second, information is still vague at best on the expected duration of COVID-19 and long-term impact on the global population. Third, numerous proposals are being floated and discussed by the various government and regulatory agencies that will impact the economy. We could go on, the point is there is too much unknown to make adjustments to quantitative metrics and then have confidence in the rigors of those goals for the duration of the year. As such, if adjustments are being considered, delaying adjustments until greater normalization occurs is likely the most prudent path.

At the end of the day, with the right information at their disposal, compensation committees will be in a good position to assess the performance of their management teams with confidence. The use of discretion is increasingly prevalent in volatile market environments, and we expect to see a marked increase in its use, in both positive and negative, in fiscal 2020 relative to prior years.

Long-Term Incentives

Annual incentives are complex in these circumstances, but that level of complexity pales in comparison relative to long-term incentives. “Black swan” events not only impact future award strategies, but also past awards and their desired impacts. Looking back at the table under the base salary discussion, while recognizing that the sample size is quite small, those companies were generally down over 50% since the start of the year. This has meaningful impacts on “paper value” of outstanding awards and modeling of realized compensation outcomes. However, the increased adoption of relative total shareholder return performance metrics in long-term incentive awards for executives will likely soften the blow of the volatility on pay outcomes from a share count perspective, and with the increasing use of stock ownership guidelines and retention requirements executives will be able to allow time to pass which hopefully brings back a level of normalcy to economic conditions. Given the expected challenges and negative reactions to adjusting performance hurdles for past awards, we recommend companies currently focus on what they should be doing for awards yet to be granted in 2020. Some strategies to consider:

1. DELAY THE GRANT DATE

The easiest action to take, if customary grant dates are approaching, is delaying the grant of long-term incentives to buy time to let some degree of volatility subside. Or at a minimum, the increased amount of time will firm up leadership’s views on the competitive environment in the medium-term and allow companies to react appropriately. One downside to this strategy is the longer LTI recipients go past the customary grant date, the more companies put themselves at risk with respect to employee retention. To counter this, we recommend that when awards are ultimately granted, vesting dates reflect the customary granting schedule to regain consistency to past practice and employee expectation.

2. USE FULL-VALUE VEHICLES INSTEAD OF APPRECIATION VEHICLES

For companies that have historically used appreciation vehicles like stock options or stock appreciation rights, lower share prices will have a material impact on the burn rate of authorized shares for LTIP programs. As shareholders are rightfully sensitive to dilution, it may be better served in times of volatility to use full-value awards like restricted stock/units and/or performance shares/units to deliver long-term incentive compensation. Full-value awards lessen the burn rate impact in most circumstances, and the use of performance shares allows companies to provide “performance-based” compensation that their shareholders are accustomed to seeing.

3. USE CASH-BASED VEHICLES

Another burn rate mitigation strategy, is using cash-based vehicles to provide long-term incentives, as this mitigates share usage in depressed pricing scenarios and conserves shares in the authorized LTIP pool. The main drawback here is the accounting treatment of such awards and the resulting impact on financials.

4. LEAN ON RELATIVE PERFORMANCE METRICS

In some industries, performance metrics that are based solely on company performance (absolute) are most prevalent. In times of volatility, relative performance metrics may provide a better optic of management performance and allow participants to keep line of sight to impact compensation outcomes. When designed appropriately, relative performance metrics soften the impact of volatility on compensation programs caused by macro-economic factors.

5. USE LONGER AVERAGE TRADING PRICES

As we noted earlier, lower share prices equal higher burn rates since more shares are used to provide target dollar value opportunities. Some companies may elect to extend the historical trading period utilized to set share price denominators when making awards. This would be an effort to effectively reduce the number of shares granted, as the base price would be most likely be higher than today’s value. It is important to note that some executive teams may view this as unfavorable as it reduces the number of shares they would receive. The most prevalently used trading averages are 30- and 60-day.

Lastly, it is important to take note of any provisions within equity plans that cap award values, often communicated in both numbers of shares and dollar values that can be provided on an annual basis. The elimination of certain elements of Section 162(m) removed the need for limits, but they have become commonplace and expected by shareholders and their advisory firms. Certain industries, energy in particular, may have to get fairly creative in their approach to long-term incentive awards throughout the remainder of 2020 as a result of these limitations.

While we eagerly look forward to the day the COVID-19 pandemic is behind us, in the interim, thoughtful action on incentive compensation will be critical in companies’ efforts to retain and motivate the human capital needed to navigate the challenges ahead. We offer this guide up as a high-level playbook to aid those efforts and are here to assist our clients through the strategic challenges COVID-19 will bring to bear in the near-term.